2026 promises to be challenging for Ukrainian agricultural producers. Economic instability, currency fluctuations, prices for fertilizers and fuel, as well as general challenges of the agricultural market require a serious approach to financial planning. A properly formed budget is not only a guarantee of business preservation, but also a chance to use seasonal opportunities with maximum efficiency.

Why Financial Planning should Start in Autumn

During the off-season, the farm has the opportunity to focus not on field work, but on strategic analysis. Right now it is convenient to assess the results of the year, forecast production volumes, review suppliers, set aside reserves for force majeure and plan investments. The financial plan for 2026 is the basis for negotiations with banks, funds, suppliers and partners.

Assessment of Previous Season Results

Before planning the new year, you need to summarize the financial results of the 2025 season:

- how much did a hectare of cultivation cost by crops;

- what were the costs for equipment, repairs, fuel;

- how did prices for plant protection products, fertilizers, seeds change;

- how much profit or loss each field generated;

- which investments paid off and which did not.

This analysis will become the starting point for forming next year’s budget.

Revenue Forecasting: Realistic and with Margin

In an agricultural producer’s budget, it is important to approach revenue forecasting carefully. Consider:

- average market prices (not peak);

- probable risks of falling purchase prices;

- expected yield based on agrochemical analysis and weather forecasts;

- storage possibilities and deferred sales.

It is good when the budget has two scenarios: basic (realistic) and conservative (minimum income + unforeseen expenses).

Cost Optimization: where You Can save and where You Cannot

Budget planning for 2026 should start with expense items. They can be conditionally divided into:

- Mandatory: seeds, plant protection products, fuel and lubricants, rent, taxes;

- Variable: equipment modernization, additional crops, consulting services;

- Investment: irrigation, elevator facilities, IT solutions.

Saving on plant protection products or fertilizers is a path to reduced yields. Instead, it is worth reviewing approaches to storage, sales, partner selection and financing instruments.

Lending, Installments and Financial Instruments

The plan for 2026 cannot be imagined without attracting financial instruments. Today, a farmer has several options:

- Installment: allows buying resources now and paying later from profit;

- Factoring: receive funds for future harvest;

- Bank lending: longer term, but more requirements for collateral and reporting;

- Leasing: equipment or machinery with monthly payments.

Online services, such as WEAGRO, allow you to quickly, without paperwork and visits, arrange installments for up to 180 days, which is especially relevant in autumn and winter.

Currency and Inflation Risks

The budget should provide for part of the expenses in foreign currency — for example, imported plant protection products or equipment. Sharp exchange rate fluctuations can destroy the plans of even the most disciplined farmer. To protect yourself:

- form part of working capital in foreign currency;

- agree with suppliers on a fixed exchange rate;

- make reserves for exchange rate losses.

Similarly, inflation affects prices for fertilizers, logistics and wages. A reserve of 10–15% in the budget is reasonable protection.

Personnel Costs and Efficiency Improvement

In 2026, an increase in minimum wage and pressure on the payroll fund is expected. It is worth reviewing the team structure, investing in accounting automation, using CRM or agricultural platforms. Some services are better outsourced (accounting, audit, financial monitoring) than kept in-house.

Read also: Winter equipment storage: tips and proven practices

Taxes and Legislative Innovations

Follow updates: changes in income tax, personal income tax, rental rates, military levy or benefits for the agricultural sector can significantly affect your budget. In 2026, adjustments to single tax rates or strengthened control over cash circulation and transactions with individual entrepreneurs are possible.

Regular consultation with an accountant or tax consultant is not an expense, but a guarantee of financial stability.

Investments in Sustainability: not just about Equipment

Planning should include not only production costs, but also reserves:

- for risks (weather, market, political);

- for development (new directions, crops, processing);

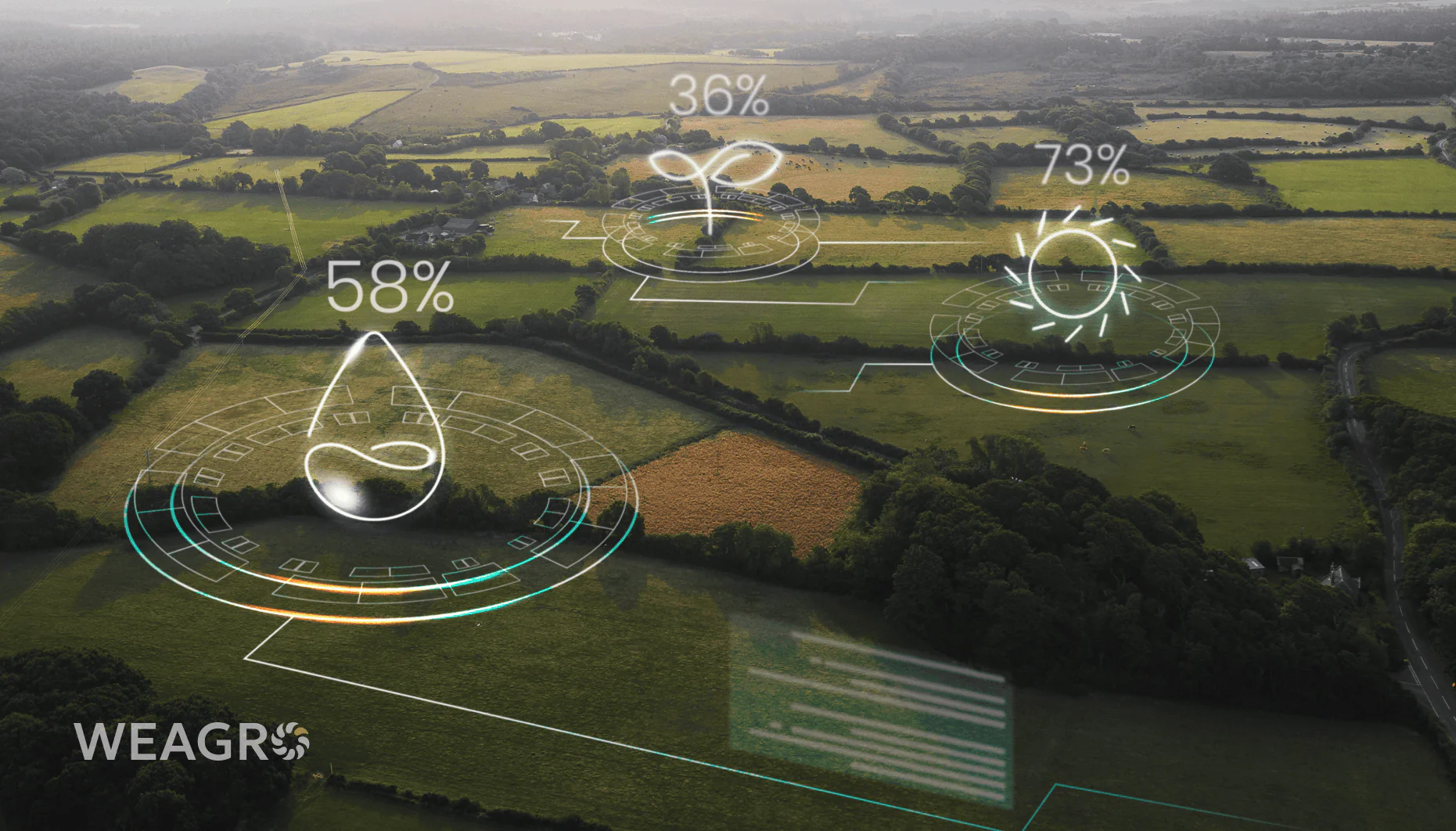

- for productivity improvement (innovations, precision farming, agricultural analytics).

More and more farms are allocating part of their budget to climate resilience: drip irrigation, green manure, biological preparations — all this in 2026 is transforming from fashion to necessity.

Read also: Autumn soil preparation: modern approaches and equipment

Conclusion

Financial planning for agribusiness is not just an annual routine. It is a complex but important tool that allows farmers to adapt to instability and plan development with less risk. 2026 will be a year of decisions: either proactive planning or reaction to challenges. And those who prepare in advance will win.