The Ukrainian agricultural sector still faces chronic problems:

- high threshold for access to finance due to collateral requirements and bureaucracy;

- lack of working capital during peak demand seasons;

- banks mostly ignore agricultural producers with land banks up to 500 hectares;

- micro-businesses are forced to finance through retail card products;

- financial institutions are barely integrated with digital B2B services, which hinders the scaling of innovative financing.

But what if access to loans became simple, digital, and fast, without queues to the notary and without a bureaucratic marathon? This is exactly what we are working on at WEAGRO, developing a digital module for issuing agrarian notes – a new financing instrument for agricultural producers.

What is an agrarian note?

The new type of agrarian receipt is a debt security that allows an agricultural producer to receive goods or financing today, securing it with future harvest. It works similarly to classic agrarian receipts but with a simplified procedure, without mandatory notarization. This is why it paves the way for mass use of short-term commodity or credit financing.

According to market estimates, up to 1,000 agrarian receipts are issued annually in Ukraine, but the potential is dozens of times greater. Out of over

How will the Agro note module from WEAGRO work?

We are creating a solution that will allow forming an agrarian note in one click:

- Intuitive interface

- Automatic data filling

- Artificial Intelligence — for data validation and document formation to minimize human error as much as possible

- The entire process can be completed online using a QES (qualified electronic signature).

- WEAGRO partners – suppliers and traders – can generate notes themselves for their clients through integration with internal systems / ERP systems.

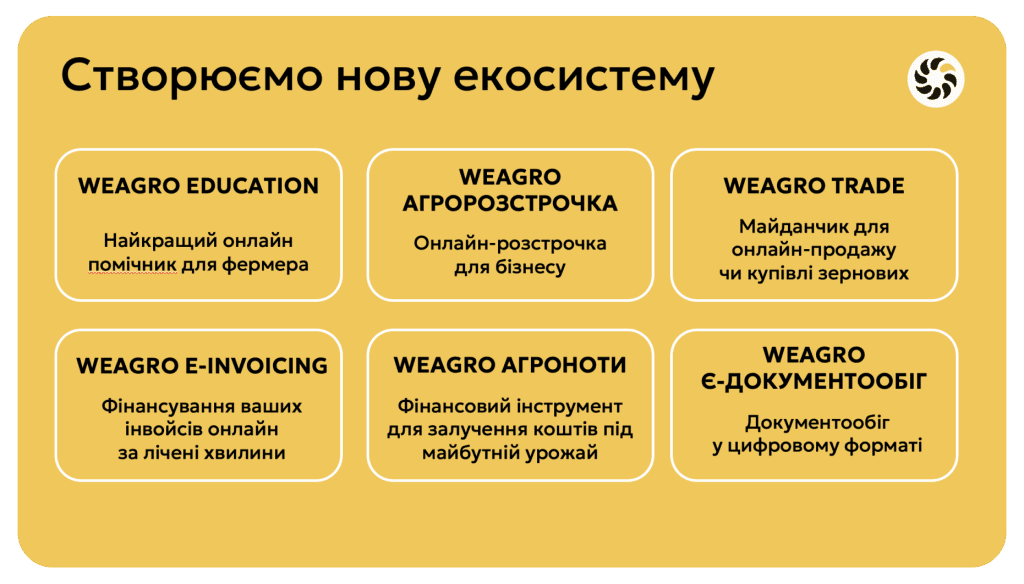

We are creating a new level digital ecosystem — modules integrated into a unified digital environment that covers the entire process of servicing small farms.

International Experience

Digital agro-financing tools are rapidly developing worldwide. For example, in Brazil, over

Prospects

Thanks to the new module from WEAGRO, we expect that agrarian notes will become:

- A mass financing instrument for agribusinesses up to 1000 hectares,

- An effective alternative to collateral lending in conditions of lack of liquid collateral,

- A liquid financial asset suitable for secondary circulation.

WEAGRO is not just technology. It’s a new financing culture — a

And we are open to partnerships — with banks, IFIs (international financial institutions), funds, and input suppliers. Because WEAGRO’s goal is scaling trust and capital for the benefit of Ukrainian farmers.