Installment is a type of financing for purchasing goods. It’s based on a simple and understandable mechanism – “buy now, pay later,” without commissions or interest charges for the buyer. It’s familiar to those who have used “partial payments” when buying, for example, a smartphone, household appliances, furniture, etc.

But the possibilities of installment should not be limited to consumer goods.

Today, thanks to our WEAGRO service, all representatives of micro, small, and medium-sized agricultural businesses can buy goods without overpayments and with deferred payment. The financial product works on the same principle of “buy now, pay later,” and allows you to:

- maintain liquidity;

- increase the purchasing power of the enterprise;

- scale activities

Our agro-installment is an effective financial tool for Ukrainian farmers and an accessible opportunity for them to develop their business.

What is Installment

Theory and statistics will help to understand and determine who needs this financial service and how important it is.

So, installment is a form of purchase where the buyer can divide the cost of a product or service into several equal payments. They are paid over a set period without interest or additional fees.

Installments can be provided by financial institutions that have a factoring license. In practice, however, financial assistance often comes down to lending, where the farmer borrows money at interest and faces many bureaucratic difficulties.

The Realities of Modern Loans for Agribusiness: What the Cabinet of Ministers and Statistics Say

The agro-loan market has undergone a number of changes from 2022 to 2024. But for banks, agricultural enterprises remain the most desirable borrowers today, as they have been for the past 10 years. Not only state lenders but also private ones compete for them.

According to the reported data of the Entrepreneurship Development Fund, in 2023, approximately 14,000 farms received loans totaling 79 billion UAH.

The majority of the funds (44.5 billion UAH) were allocated under the “Affordable Loans 5-7-9” program. They accounted for almost half of the financing offered to businesses by the state in 2023. This confirms the opinion that agro-loans remain a fairly popular financial service in our country.

Analyzing the beginning of 2024, one can notice a trend of transition from preferential lending to market-based lending, where money is more willingly issued against land collateral, and the annual interest rate is approximately 18%.

In the future, according to the Cabinet of Ministers, this approach should facilitate the start of operations of a non-banking institution known as the Partial Credit Guarantee Fund in Agriculture. It was created as part of the cooperation between the Ministry of Agrarian Policy, the EU, and the World Bank to support farmers who cultivate up to 500 hectares of land.

It is expected that the fund will issue a guarantee that can cover the collateral deficit to obtain the necessary loan amount, stimulate lower interest rates, and open up new opportunities for farmers to attract funds and develop their business.

Farmers’ Problems and Their Affordable Solutions

While the fund established by the Cabinet of Ministers is in the process of formation and awaiting changes in the regulatory framework, small and medium-sized farmers are independently solving the issue of where to find “cheap” money and face urgent problems:

- High annual interest rates, which significantly increase the financial burden and make lending inaccessible to farms, especially those with limited resources.

- Limited access to credit for small and medium-sized farmers compared to large ones. The former often cannot obtain loans due to lack of credit history or adequate collateral.

- Economic instability, which leads to fluctuations in agricultural product prices, complicates farming activities and creates risks for lenders. As a result, banks are forced to tighten lending conditions or raise interest rates.

- Bureaucratic and legal difficulties, which consist of unclear and non-transparent financial and legal requirements.

- Lack of risk insurance, particularly economic and currency risks, which makes lending less attractive.

These problems can be solved by installment as a transparent and effective tool for planning and diversifying financial flows. It comes to the rescue at the very moment when there is a need to quickly purchase necessary products without losing a significant stock of own funds.

How it Works for Agribusiness – Using WEAGRO as an Example

WEAGRO is an online service where the seller (supplier of goods or services) and the buyer (farmer) meet and interact with each other online:

- The buyer pre-orders the goods, and the seller sends an application to arrange an installment purchase agreement on the WEAGRO website.

- Within 30 minutes, a response comes about the possibility of arranging an installment plan.

- After signing the purchase agreement, money is credited to the seller’s account, and the buyer receives the paid goods or service and new payment details according to the installment schedule.

No collateral or guarantee is required to issue the money – a purchase agreement is sufficient.

And how much and when to Pay?

The farmer can independently choose the more convenient form of payment for them. This can be payment in installments – for a period of up to 180 days. The amount is divided into equal payments, which are made on the last day of the month. And payment with deferment – for a period of also up to 180 days, with settlement at the end of the installment term.

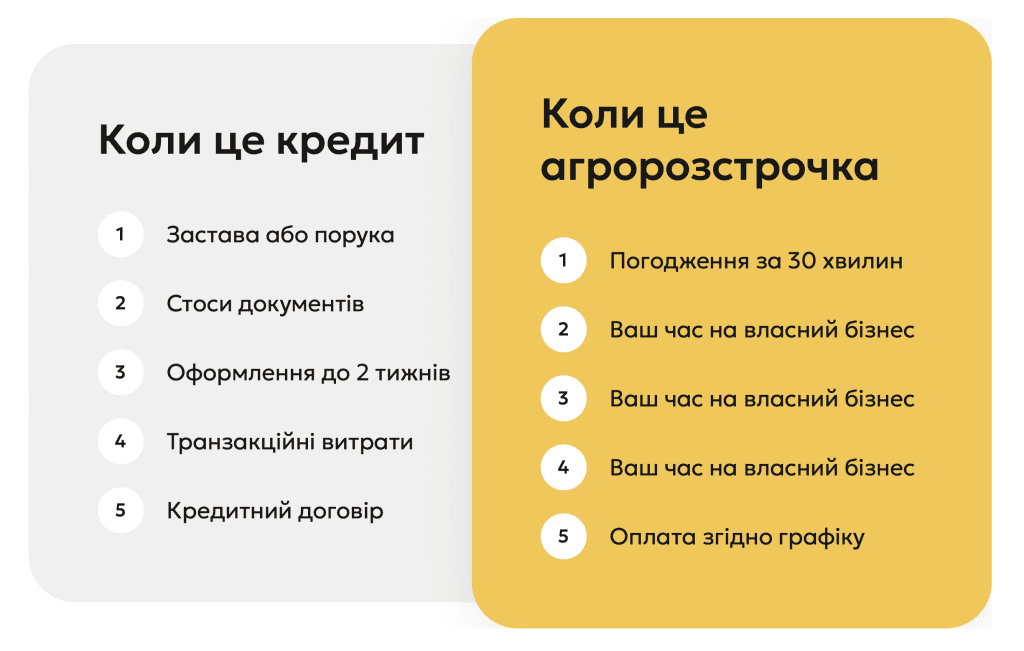

The Difference between a Loan and Installment

A loan is a popular banking product that allows solving urgent financial problems or buying goods when there are not enough own funds. Like installment, it is issued by a bank or financial institution, but already with interest, which forms a significant amount of overpayment at the time of loan repayment. But this is not the only difference between a loan and installment.

The comparative characteristics of issuance conditions, shown in Table 2, will help understand the main advantages and disadvantages.

Image 1. The difference between a loan and installment

In summary, the main advantage of a loan is the ability to arrange borrowing for a long term (over a year) in the form of live money to the account.

But installment allows you to get funds in a minimum short time, without paperwork, hidden costs, and overpayments.

This is the approach offered by our WEAGRO service. Using it, the farmer directly interacts with the supplier and avoids direct contact with the bank or financial company. They receive a decision on issuing installments within 30 minutes, and the seller receives payment under the contract within a day.

The entire financial process is controlled by a factoring company, which checks the borrower’s solvency, transfers funds to the seller, and accompanies the buyer, if necessary, until the end of the contract term.

Information about the loan is formed in the personal accounts of the seller, buyer, and factor, ensuring transparency of the transaction and clear interaction between the parties.

Conclusion

WEAGRO, offering an innovative financial service, expands opportunities for agribusiness. It allows the farmer to make more purchases or choose more expensive goods without worrying about the negative impact on their balance, distributing the purchase costs over a longer period.

And agricultural goods suppliers who become WEAGRO partners will be able to expand their customer base, increase sales volumes, and reduce the risks of non-payment.

Start using WEAGRO today and discover many new opportunities.