In Ukraine’s unstable economy, the issue of liquidity is not just a financial formality, but a daily challenge for farmers. Timely payments for crop protection products, fuel, fertilizers, wages, land rent – all depend on the company’s ability to promptly cover its obligations. But what is liquidity really? It’s not just having funds in the account. It’s a system that ensures uninterrupted cash flow throughout the agricultural season.

Even profitable enterprises can find themselves in a financial trap if they can’t settle with counterparties on time. The reason is the lack of a flexible financial plan or gaps between expenses and income. This is especially relevant in autumn when farms finish the season, calculate results, and plan for the next one.

Main Sources of Liquidity Risks in the Agricultural Sector

In agribusiness, maintaining liquidity is complicated by several factors. First, seasonality. Income is often concentrated in one or two quarters, while expenses are spread over time. Second, delayed payments from counterparties – traders, cooperatives, or the state. Third, unpredictability: weather disasters, rising costs of imported resources, currency fluctuations.

Add to this the general economic instability, logistical complications, and the war factor – and we get an environment where it’s almost impossible to survive without quality financial management. That’s why the topic of liquidity should become a priority for every farm manager.

The Role of Payment Calendar and Budgeting

Proper liquidity management starts with the basics – monthly budgeting. The payment calendar is one of the main tools. It’s not just a table of dates and amounts. It’s an analytical model that allows you to:

- assess expected income and expenses;

- identify potential cash gaps;

- understand when and how much money will be needed to pay critical obligations;

- forecast liquidity deficits and find financing in a timely manner.

In a well-organized enterprise, the payment calendar is updated weekly – taking into account new contracts, payment deferrals, receipts from state programs, etc.

Working Capital Management: the Foundation of Financial Flexibility

One of the critical aspects of liquidity is working capital. Its effective use allows not only to cover current needs but also to reduce the cost of raising funds. In particular, we’re talking about:

- Control of product balances: frozen inventory is “dead” money.

- Assessment of accounts receivable: the longer your buyer doesn’t pay, the higher the liquidity risk.

- Optimization of payment schedule: in negotiations with suppliers, it’s worth agreeing on flexible payment terms.

In 2025-2026, the average agricultural enterprise in Ukraine keeps 30-40% of its funds in the form of inventory or deferred payments, which could be transformed into cash flow through factoring or installments.

Installment as a Tool for Maintaining Liquidity

Alternative financing is another important direction. Installment plans for purchasing resources (seeds, machinery, fertilizers) allow farmers to get what they need “here and now,” paying from future period profits. Thanks to this:

- there is no burden on working capital at the time of purchase;

- the risk of cash gaps is reduced;

- the company maintains financial flexibility and readiness to respond to unexpected challenges.

At WEAGRO, we see how farmers effectively use installment plans to maintain liquidity during sowing, autumn machinery repairs, or purchasing crop protection products. This is not a credit story, but a management decision – and that’s how it should be perceived.

The Importance of Monitoring and Early Response

Financial indicators are not just accounting, but a way to predict problems. Monthly analysis of the current ratio, accounts receivable turnover, inventory, and payment terms allows you to see the problem area before accounts “go into the red.”

It’s especially important not to remain alone with the problem. In many cases, liquidity can be preserved by turning to financial partners even before the gap begins. Pre-agreed installment limits, partnership agreements on factoring, readiness for restructuring – all these are part of the liquidity management system.

Conclusions: Liquidity is not about Survival, but about Stable Growth

Managing liquidity is not just about avoiding bankruptcy. It’s about the ability to grow, respond to the market in a timely manner, invest in development. Agricultural enterprises that maintain solvency even in crisis periods have a higher credit rating, better purchasing conditions, supplier trust, and the ability to develop in the long term.

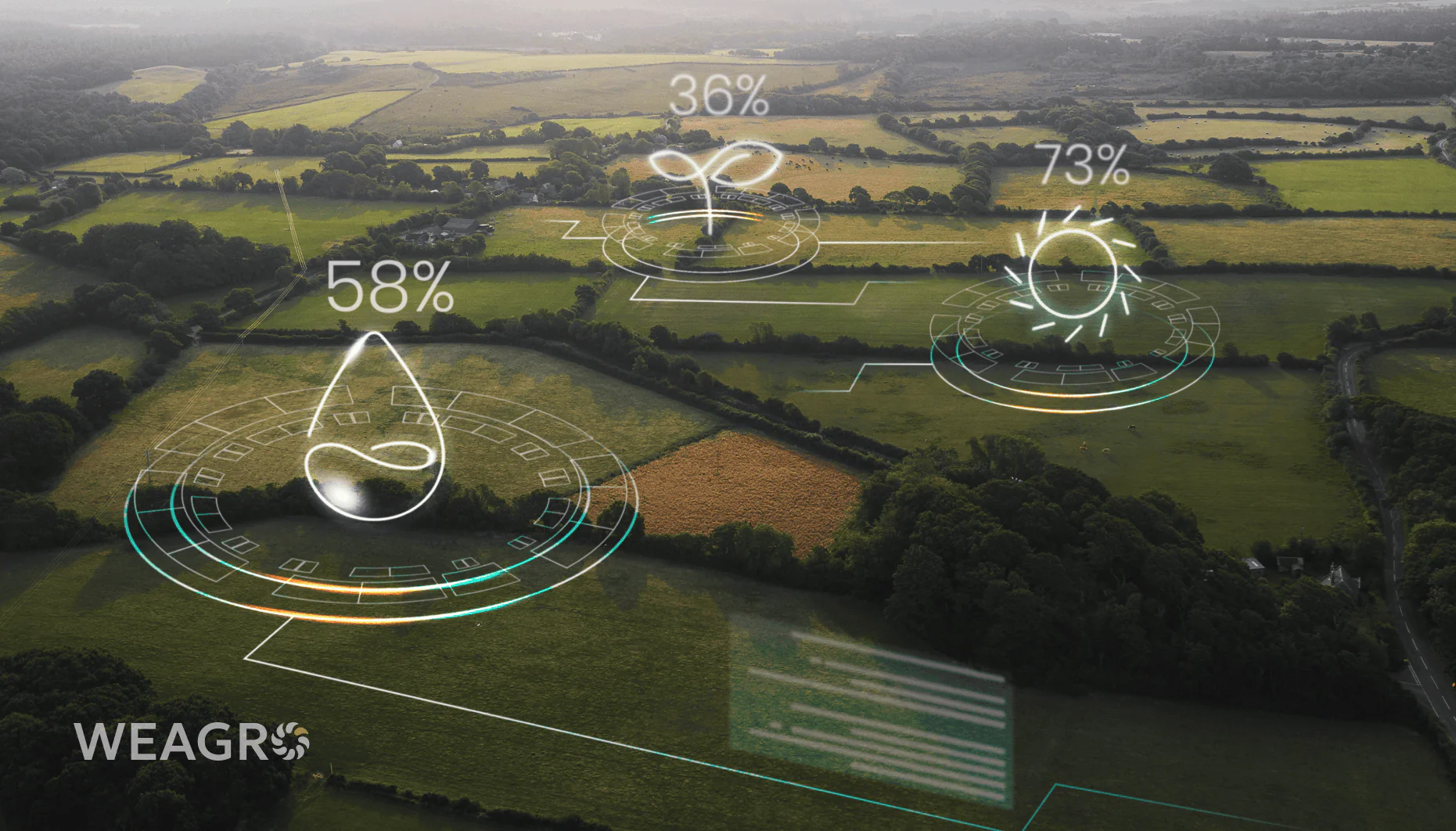

In the 2025-2026 season, these skills are not an advantage, but a requirement of the times. And most importantly – the tools for this already exist: analytics, payment systems, installments, agro-financial services.

If you’re looking for flexible solutions to maintain liquidity in your agribusiness – pay attention to the possibilities of agricultural installments through WEAGRO. Decision in 30 minutes, without banks, without paperwork.