Why the issue of working capital becomes critical specifically in February

February for agribusiness is a period when most key decisions seem to have been made, but the financial picture of the season is not yet finalized. Sowing is approaching, expenses begin to concentrate, while revenue remains in the future. It is at this moment that the issue of working capital transitions from theoretical to practical: will there be enough resources to get through the season without stops, emergency decisions and loss of control.

In practice, most liquidity problems in agribusiness do not arise in spring or in the field. They form in winter, when the farm either underestimates the real volume of future expenses or overestimates available financial capabilities. February is the last month when these mistakes can still be seen and corrected without critical consequences.

Working capital as the foundation of seasonal stability

Working capital in agribusiness is not just “money in the account.” It is a financial safety margin that allows the farm to perform all operational processes until receiving the first revenue. In crop production, this period can last five, six, or sometimes more months. Throughout this entire time, the business lives off working capital resources.

The key mistake is that working capital is often perceived as a remainder from the previous season. In reality, it is a separate financial indicator that requires conscious planning. If working capital is insufficient, even a profitable farm can face cash gaps, procurement delays or forced compromises in technologies.

Why “eyeballing it” no longer works

Just a few years ago, many farmers could afford to plan the season “by feel.” Today, this model increasingly fails. Rising resource costs, price instability, logistical risks and limited access to external financing sources make intuitive decisions dangerous.

In February, agribusiness already has enough information to move from assumptions to concrete calculations. It is at this moment that it’s important not just to estimate the total amount of expenses, but to understand their structure, time distribution and impact on liquidity.

What expenses need to be considered first

Planning working capital before sowing begins with a complete list of future expenses. The problem is that most farms see only obvious items, ignoring less noticeable but no less important elements.

In February, it’s worth reviewing not only the sowing budget, but all related expenses that accompany the season. This includes payment for resources, logistics, equipment repair, personnel costs, energy carriers, land rent and tax payments. Each of these items can affect liquidity at different moments of the season.

It is especially important to consider the time gap between paying for expenses and receiving results. Most resources are paid for long before they begin to “work” on the harvest.

Time factor as the main risk

One of the biggest traps in working capital planning is ignoring time. Even if the total amount of resources is formally sufficient, incorrect distribution of payments over time can lead to cash shortages at a specific moment.

February is the ideal time to build an expense calendar. This doesn’t necessarily have to be a complex financial model. It’s enough to understand in which months the burden on liquidity will be maximum, and whether there is a financial reserve during these periods.

It is here that many farms first realize that the problem is not in the total amount of money, but in their availability at the right moment.

The role of the previous season in planning the new one

Assessing working capital is impossible without analyzing the previous season. However, it’s important to read this data correctly. The fact of last year’s profitability does not yet mean financial readiness for the new one.

In February, it’s worth looking not only at the final result, but at the dynamics of cash flows throughout the year. At what moments did tension arise, where did you have to defer payments or seek temporary solutions. These points are the best indicators of future risks.

Why working capital gets “eaten up” even before sowing

Many farmers are surprised why even before the start of active work, the financial reserve begins to shrink. The reason often lies in the accumulation of small expenses that are not perceived as critical, but in total create significant burden.

Winter months are a period of active preparation: purchases, advance payments, service work. If these expenses were not included in the general working capital model, in March the farm may find itself in a situation where formally everything is ready, but financial flexibility is already gone.

How to assess the real need for working capital

The practical approach to assessing working capital in February lies not in searching for the “perfect formula,” but in honestly answering several key questions. What is the minimum volume of expenses needed until the first revenue? Which payments are critical and cannot be postponed? What financial reserve remains after covering them?

It’s important to understand that working capital is not the maximum that can be spent, but the minimum below which the business begins to lose stability.

Working capital and quality of decisions during the season

Insufficient working capital reserve almost always affects the quality of management decisions. The farm begins to economize not where it’s advisable, but where it’s possible to save quickly. This can mean refusing optimal technologies, postponing important operations or choosing less effective solutions.

In the long term, such compromises cost more than timely financial planning.

Why February is the last chance to calculate everything calmly

March and April in agribusiness are periods of quick decisions and high pace. At this time, there is no space for deep analysis. That’s why February is a critical month for working with working capital.

In February, you can still adjust procurement schedules, review the approach to expenses, find more flexible solutions for getting through peak periods. After sowing starts, most of these opportunities disappear.

Working capital as a strategic, not technical indicator

Working capital is often perceived as a technical financial detail. In reality, it is a strategic indicator that directly affects the season’s results. A farm with sufficient liquidity reserve has freedom of choice. A farm without such reserve works in constant reaction mode.

That’s why the issue of working capital in February is not about accounting, but about business management.

Practical tools

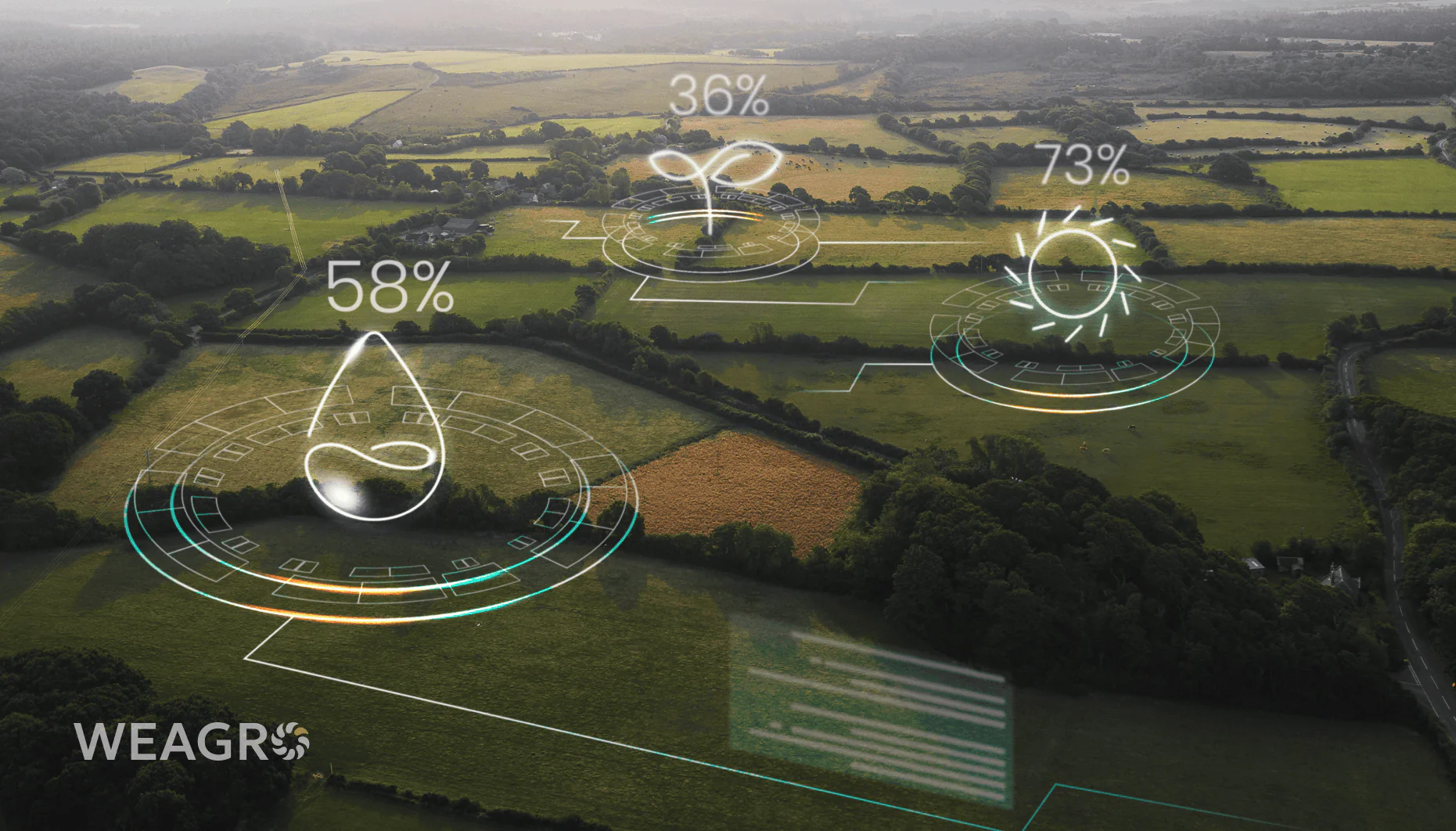

In modern conditions, agribusiness increasingly seeks tools that allow flexible management of financial flows without excessive bureaucracy. Online solutions that help distribute burden over time and plan expenses before the season starts become part of financial strategy, not a one-time solution.

This approach allows agricultural producers to maintain control even during periods of peak expenses.

Conclusion

Working capital for agribusiness before sowing is not an abstract financial term, but a practical tool for survival and development. February is the last month when it can be calmly calculated, the real need understood and the business prepared for the season without unnecessary stress.

Those farms that pay attention to this issue while still in winter enter the season from a different level — with control, flexibility and the ability to make decisions, not just react to circumstances.